Source: FTSE Russell 4 Good Index series

FTSE Russell is a British provider of stock market indices and associated data services, wholly owned by the London Stock Exchange (LSE). FTSE Russell has been at the forefront of innovating ESG indexing for nearly two decades. The FTSE4Good Index Series is a market-leading tool for investors seeking to invest in companies that demonstrate good sustainability practices. It also supports investors who wish to encourage positive change in corporate behavior and align their portfolios with their values.

Understanding the comprehensiveness of the indices and level of transparency it provides to the investor, we agreed to participate in the ESG rating under FTSE 4 Good Index series. This index family is based on the 14 themes areas under environment, social and governance pillar. Relevant information was made available for indicators under these themes.

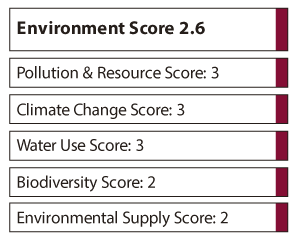

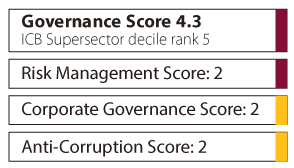

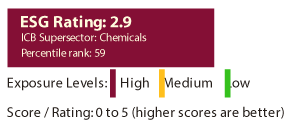

The overall score is determined basis the performance in the individual pillars of ESG. We have achieved a total score of 2.9 with a percentile rank of 59. The detailed scoring with the themes are as below:

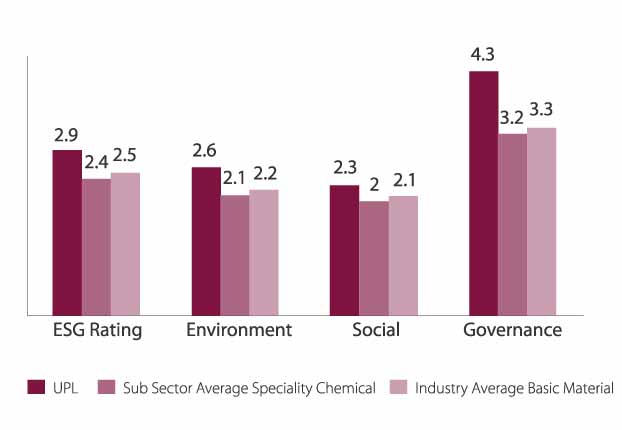

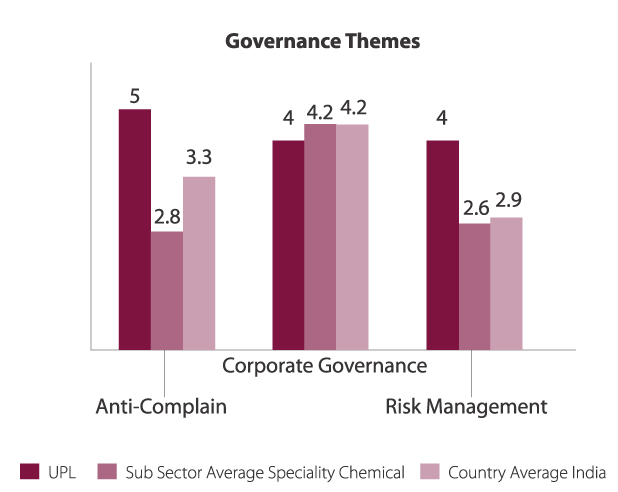

The rating also evaluates the performance on governance indicators across the subsector and industry average to evaluate the company score based on the subsector and industry performance. UPL has showcased performance better than the subsector companies and industries in similar business. The detailed scoring for the same is as follows:

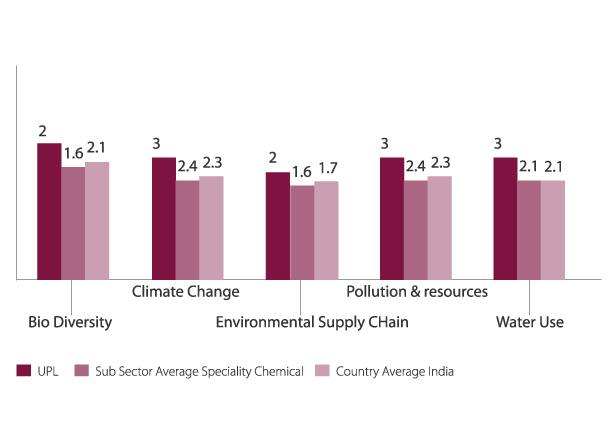

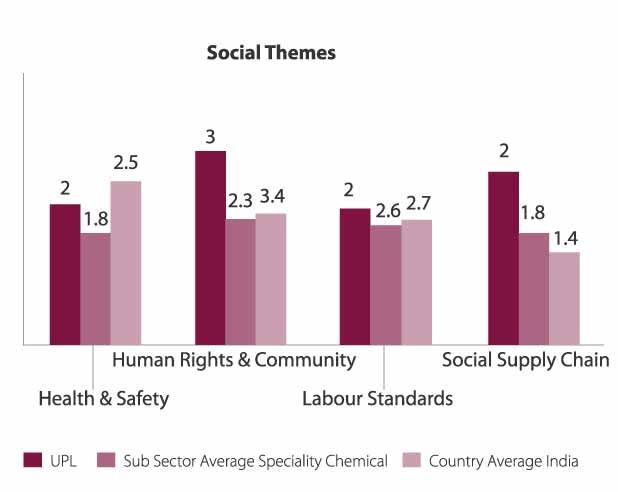

UPL's performance was also evaluated and benchmarked against the subsector companies and the companies across sector in our country. The scores were allotted on the basis of performance across various thematic parameters. The detailed scores are as below:

S&P Dow Jones Indices partners with RobecoSAM, a specialist in sustainability investing, to provide investors with objective benchmarks for managing their sustainability investment portfolios. The DJSI allow the creation of portfolios of companies that fulfill certain sustainability criteria better than the majority of their peers within a given industry. The Dow Jones Sustainability Indices (DJSI) measure the performance of companies selected with economic, environmental and social criteria using a best-in-class approach.

The Dow Jones Sustainability Emerging Markets Index comprises emerging-market sustainability leaders as identified by RobecoSAM. It aims to represent the top 10% of the largest 800 companies in 20 emerging markets based on long-term economic, environmental and social criteria and UPL was selected in the top 10% companies which were invited to participate in the DJSI Emerging market index

UPL has improved the overall scoring by 57% as compared to 2017 results and we continuously strive to improve further. Some of the focus areas where we will be enhancing our performance further are:

Economic Dimensions

Environmental Dimensions

Social Dimensions