Governance systems take into account essential elements like Board effectiveness, structure, diversity, experience and expertise as well as management ownership. Keeping in mind these critical factors the Board at UPL consists of 12 Directors with 2 female Directors and 6 Independent Directors. Board diversity allows evaluation of problems from a broader perspective and take into account the best interests of all stakeholders. We have a market presence in 130+ countries across six continents, in the fast-growing agro markets of Brazil, India, Mexico, China, Australia, the US, Argentina, France and South Africa, among others.

Executive Chairman

& Managing Director,

Promoter Director

Promoter Director

Global CEO of the Group,

Promoter Director

Executive Director,

Promoter Director

Director Finance

Whole-time Director

Independent Director

Independent Director

Independent and Non-Executive Director*

Independent Director

Additional Director,

Independent and Non-Executive Director

Additional Director,

Independent and Non-Executive Director

Together, the Board deliberates upon matters of material importance and collaborates to set the tone at UPL upholding our standards of best-in class governance practices. Their versatility in experience and in-depth understanding of the industry guides the management to work towards our vision, mission, values, strategies, policies and targets pertaining to the ESG parameters. These are communicated very strongly and thus percolate at every level of control in our operations. The Board of Directors are meant to represent stakeholders and are an integral component of corporate governance. It is therefore important that the board members selected have the right mix of experience and skills and are adequately independent which enables them to act in the best interests of all stakeholders and the business at large.

The dynamic industrial scenario is closely monitored and the Board keeps itself abreast with eminent risks, constantly evolving regulatory environment, business continuity and potential opportunities. The members of the Board are essentially experts in the fields of chemistry, social upliftment, agri-inputs, finance, economics, food policy, metallurgy, petroleum, cement industry etc. They bring to the table their valuable insights in a myriad of realms, enriching discussions and expediting decision making.

Directors With

female Directors

Independent Directors

We stringently monitor conflict of interest and during the reporting year, there were no material transactions with Directors or their relatives having potential conflict with the interests of the Company at large. In accordance with the provisions of section 152 of the Companies Act, 2013, and Articles of Association of the Company, Mr. Jaidev Rajnikant Shroff (DIN: 00191050) and Mrs. Sandra Rajnikant Shroff (DIN: 00189012), Directors of the Company, retire by rotation at the forthcoming Annual General Meeting of the Company and being eligible, offer themselves for re-appointment. The information of Directors seeking appointment/ reappointment as required pursuant to Regulation 36(3) of SEBI (Listing Obligations and Disclosure Requirements Regulations, 2015, is provided in the notice covering the Annual General Meeting of the Company. All the independent directors have given declaration that they meet the criteria of independence laid down under section 149 (6) of the Companies Act, 2013 and Regulation 16(b) of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015.

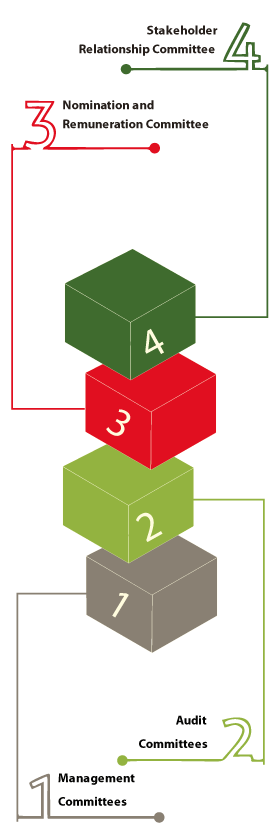

The management committees at UPL facilitate decision making at UPL under the guidance of the Board members. These committees provide expertise and strategic know-how in carrying out the functions while also ensuring there is an independent oversight of controls and risk management. The Chairman of each committee reports to the Board of Directors with matters discussed at committee meetings.

The audit committee is responsible for overseeing UPL's financial reporting process and the disclosure of its financial information to ensure that the financial statements are correct, sufficient and credible. It makes recommendation for appointment and looks at remuneration and terms of appointment of auditors of the Company. It approves payment to statutory auditors for any other services rendered by the statutory auditor. Once the auditors report on the financials the Audit Committee reviews the annual financial statements and the auditor's report to the management before submission to the board for approval.

The Nomination and Remuneration Committee is in charge of the formulation of the criteria for determining qualifications, positive attributes and independence of a Director. It recommends to the Board a policy, relating to the remuneration of the Directors, key managerial personnel and other employees. The formulation of criteria for evaluation of the Independent Directors and the Board of Directors is decided by this Committee. It devises a policy on diversity of Board of Directors and identifies qualified candidates for Directorship, who may be appointed in senior management in accordance with the criteria laid down, and recommend to the Board their appointment and removal. Decision on extension or continuation of the terms of appointment of Independent Directors, on the basis of report of performance evaluation of Independent Directors is taken by this Committee.

The Board has constituted a Stakeholders Relationship Committee, comprising two Independent and Non-Executive Directors to look into the redressal of grievances of security holders including complaints related to transfer of shares, non-receipt of balance sheet, non-receipt of declared dividends.

The Board performance is evaluated as per the provisions of the Companies Act, 2013 and Regulations 17 (10) and 25(4)(a) of the Listing Regulations. The evaluation process for performance of the Board, various committees and directors is carried out and each director is required to answer a questionnaire and provide a feedback on the overall functioning of the Board and the committees. The questionnaire covers various parameters such as composition, execution of specific duties, quality and timeliness of flow of information, discussions and deliberations of different items of agenda, independence of judgments, etc. The directors are also asked to provide their suggestions for areas of improvement to ensure higher degree of engagement with the management.

The Board is on the recommendation of the Nomination and Remuneration Committee framed and adopted the Policy for selection and appointment of directors, senior management and their remuneration. The Board recognizes that the various Committees of the Board have very important role to play to ensure highest standards of corporate governance. The Chairman of the Board and other Executive Directors form broad policies and ensure their implementation in the best interests of the Company. The criteria for selection of directors and senior management are mainly qualifications, experience, integrity, independence of the directors, etc. The remuneration to Non-executive Directors consists of sitting fees for attending Board/Committee meetings, commission and other reimbursements. As per the approval given by the members, the said commission shall not exceed 1% of the net profits of the Company. All the Non-executive, Non-Promoter Directors are paid commission on uniform basis. The Independent directors are not entitled to any stock options under the Stock Option Scheme of the Company.

The remuneration to the Managing Director and other Executive Directors consist of monthly salary, allowances, perquisites, commission and other retirement benefits. The remuneration payable to them is subject to the approval of the members of the Company. The overall managerial remuneration payable to them shall not exceed 10% of the net profits of the Company. In respect of senior management, the remuneration is based on the performance, company's performance, targets achieved, industry benchmark and compensation trends in the industry. Their remuneration consists of monthly salary, bonus, perquisites, KPIs and other retirement benefits.

Various Committees of the Board ensure highest standards of corporate governance.

The Chairman of the Board and other Executive Directors form board policies and ensure their implementation in the best interests of the Company.